Tax Law and Capital Budgeting

The Capital Budgeting Matrix for Physical Capital helps business leaders and tax advisors conceptualize and discuss the tax components of strategic options. Strategic decisions should never be made without consideration of the implications each option will have on the amount that the organization will be taxed. It is the responsibility of tax lawyers and other accounting professionals to accurately convey that impact of taxes so that business leadership can can make strategic decisions wisely. On the face of it, one option may appear to be better for the company financially, yet, because of various tax incentives, one option could actually cost thousands more in taxes. This template offers a framework to hold all the information needed for the analysis as well as details and explanation of results. This template weighs two options at a time, to ensure that all angles have been considered.

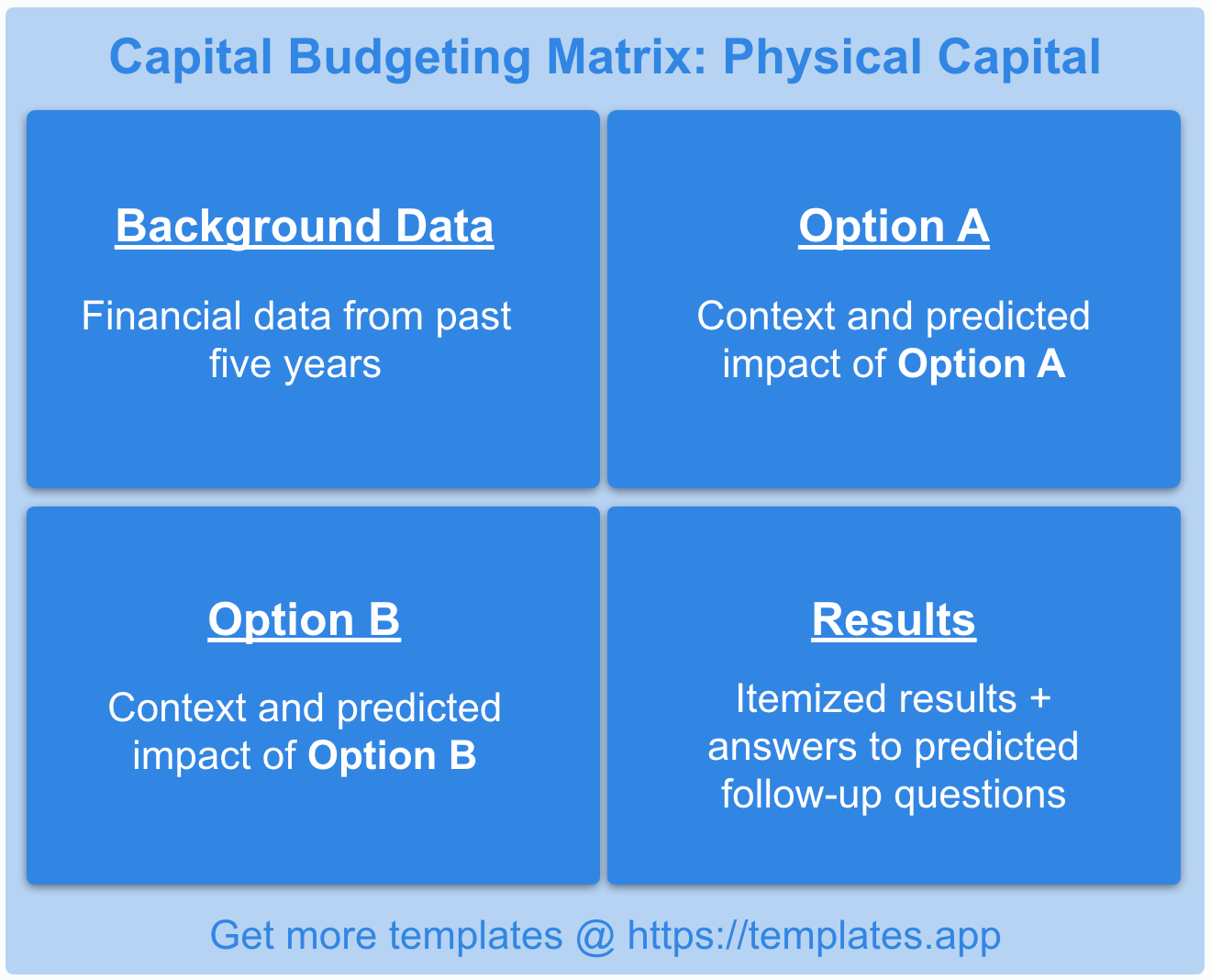

Capital Budgeting Matrix Template for Physical Capital

Quadrant 1:

Quadrant one holds all contextual information needed to begin the analysis. This includes financial data from the last five years to flesh out the organizations current financial status.

Quadrant 2:

Quadrant two holds the data on and projected impact of Option A. Here, every possible tax related ramification is illustrated in the greatest possible detail.

Quadrant 3:

Quadrant three holds the data on and projected impact of Option B. As with Option A, Option B must be comprehensively studies and results must be carefully projected.

Quadrant 4:

Quadrant four holds the results of the analysis, itemized, with answers to any other questions that can be predicted.